In the dynamic world of finance, the ability to anticipate and plan for various future states is critical. Financial Planning and Analysis (FP&A) Managers and their CFOs not only need to create comprehensive budgets and rolling forecasts, they also need the ability to rapidly create What If-style analysis.

This capability is not just a luxury—it is a critical component of strategic financial management. The creation of full scenario copies, especially those incorporating detailed models for revenue, direct costs, and employee costs, offers a suite of benefits that can significantly enhance decision-making processes. Moreover, integrating all relevant data into a single Finance Data Warehouse simplifies these operations, making scenario generation efficient and comprehensive.

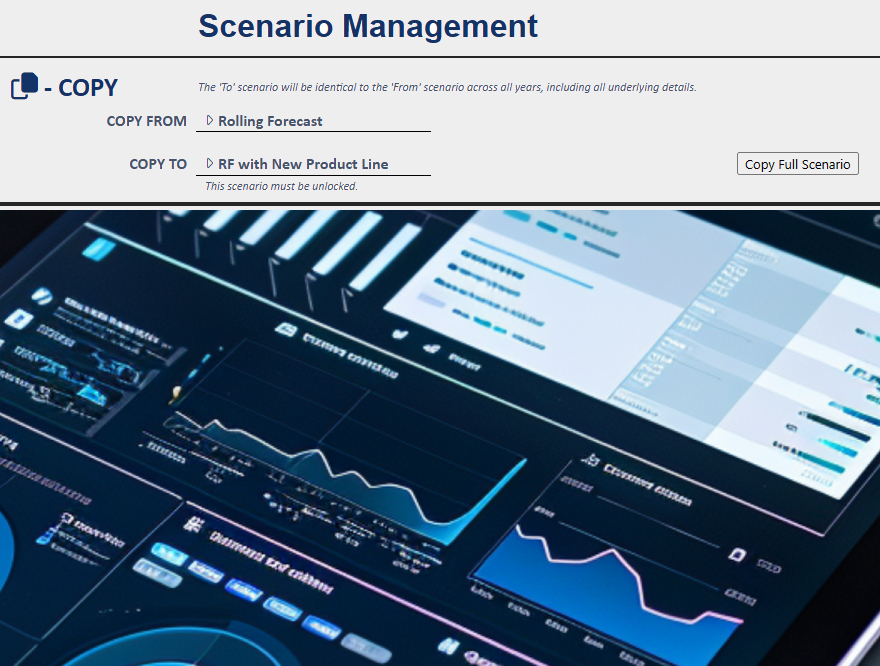

Brydens BI works with various private and listed companies, where finance users routinely make full working scenario copies. We do this primarily with SQL Server and often use Calumo as the front-end tool, as it works in Excel and has excellent online finance-style reporting.

Why is being able to create Multiple Budget and Forecast Scenarios Important?

Several years ago (as COVID started to impact everything), a frantic CFO called me; I had designed, built and continued to support their budgeting and forecasting solution. I did not normally have much to do with the CFO, as the business was large, he was busy, and his FP&A manager was really good. The solution was reasonably sophisticated, with a driver-based revenue model (updated from their internal data warehouse) and an employee model (updated from their payroll system). A small capital and funding model was also used, and other expenses were updated via direct writeback. The whole model was also 3-way in that it auto-generated most balance sheet and cash entries based on a range of cash and GST rules. Anyway, they had recently finalised their budget and were in the middle of a leadership strategic offsite. The FP&A Manager was holidaying overseas. The discussion at the offsite was all about potential COVID impacts, and the CFO was tasked with generating a range of different budget outcomes based on changes in key operations. As I said, he was frantic and breathlessly asked how long it would take to create three new budget scenarios. I thought for a second and replied… “Probably 3 to 5”… he cut me off. “No”, he said, “3 days is too long… I need this tomorrow.” I took a quick breath and said, “Sure… I was going to say 3 to 5 minutes”. He went silent, confirmed he had heard me right and was a bit stunned. To cut a long story short, I showed the team how to create the copies, discussed with the CFO what the differences between the scenarios should be and oversaw the relevant updates. That evening, the CFO reviewed them and, the next morning was able to present the draft budget options. A very happy client.

The above hit home for me. As a former CFO who has stepped in to help businesses in tough times, I understood the power of rapidly generating what-if scenarios, modelling outcomes, and proving numbers with underlying data. Obviously, this is not trivial to do in a rolling forecast scenario unless things are set up well. This is a key reason I gravitated toward solutions that use SQL Server and have an Excel and Online front-end. Below are five (of the many) advantages of setting up a Finance Data Warehouse in SQL Server and using a tool like Calumo for Budgeting and Forecasting, management reporting and automation, with a focus on Multiple Scenarios.

Five key advantages of using a tool like SQL Server with Calumo for Budgeting and Forecasting with Multiple Scenarios:

- Enhanced Decision-Making Agility

Being able to quickly generate and compare multiple financial scenarios gives CFOs, FP&A and business leadership the agility to make informed decisions in response to changing market conditions. This agility is crucial for maintaining competitive advantage and financial health. - Improved Risk Management

Multiple scenarios allow for thoroughly examining potential risks and opportunities and their financial implications. A better understanding of impacts can help develop more robust risk mitigation strategies. - Strategic Allocation of Resources

With detailed scenarios that include revenue models based on operational data and employee cost models based on staff information, organisations can strategically allocate resources to optimise outcomes. This level of precision in planning helps to prioritise investments and provides Executives with much clearer guideposts. - Increased Forecast Accuracy

Using sophisticated models that draw on a wide range of operational and employee data leads to more accurate forecasts. Rapidly showing what-if scenarios, especially when M&A is discussed, or a new product or business line is being contemplated, in the context of real operational data helps build trust and promote rapid decisions. - Streamlined Planning Processes

Centralising all relevant financial data in a single Finance Data Warehouse not only makes the creation of scenario copies relatively straightforward but also significantly streamlines the planning process. This efficiency can lead to cost savings and more time for value add and, of course, helps lay the foundation for the adoption of AI. If you have read this far, I’m sure you wondered when AI would be mentioned.

A Finance Data Warehouse that includes planning models and the ability to generate multiple scenarios quickly and without issue revolutionises how companies approach budgeting and forecasting. This paradigm shift enables a more proactive, data-driven strategy for financial planning and analysis. Tools like Calumo make using these intuitive and are ideal for many Finance reporting and automation needs. At the same time, data can also be easily curated for use in reporting-focused tools, such as Power BI to remove many of the data-related issues typical when using these tools.

In conclusion, the capacity to generate multiple scenario copies rapidly, especially when integrated with detailed operational and employee cost models, is transforming the landscape of financial planning and analysis. For CFOs and FP&A Leaders, embracing these capabilities can lead to more informed decision-making, enhanced strategic planning, and, ultimately, greater organisational success.

If you are interested in learning more, please reach out to us.

Top 3 Frequently Asked Questions on Scenario Planning

1. How does scenario planning improve strategic decision-making?

Scenario planning allows organisations to explore multiple potential futures, providing a clearer understanding of opportunities and threats. In turn, this foresight and the ease of generating multiple ‘what-ifs’ gives senior leadership additional, timely information to inform a strategic pivot in response to market or other relevant changes.

2. What are the key elements of a Finance Data Warehouse that facilitate scenario planning?

A Finance Data Warehouse that supports effective scenario planning should include comprehensive, up-to-date data on all aspects of the organisation’s operations, including sales, costs, and human resources. Integration capabilities with other business systems for real-time data updates, along with powerful analytics and scenario generation tools, are also crucial.

3. Can small and medium-sized enterprises (SMEs) also benefit from generating multiple scenarios?

Absolutely. While the scale might differ, the principles and advantages of scenario planning apply equally to SMEs. Of course, the definition of SME is pretty broad, and good solutions like Calumo come with a price tag, so basic cost benefit is important. Having said that, it definitely suits fast-growing businesses, and Brydens BI has several listed clients and larger private businesses that many would classify as SMEs. By adopting scalable financial planning and analysis tools, SMEs can leverage scenario planning to navigate uncertainty, manage risks, and make more informed decisions, ultimately supporting their growth and resilience.